Personal finance can be complex, often obscured by myths and misconceptions that can perpetuate financial hardship. This blog post aims to shed light on some of these beliefs.

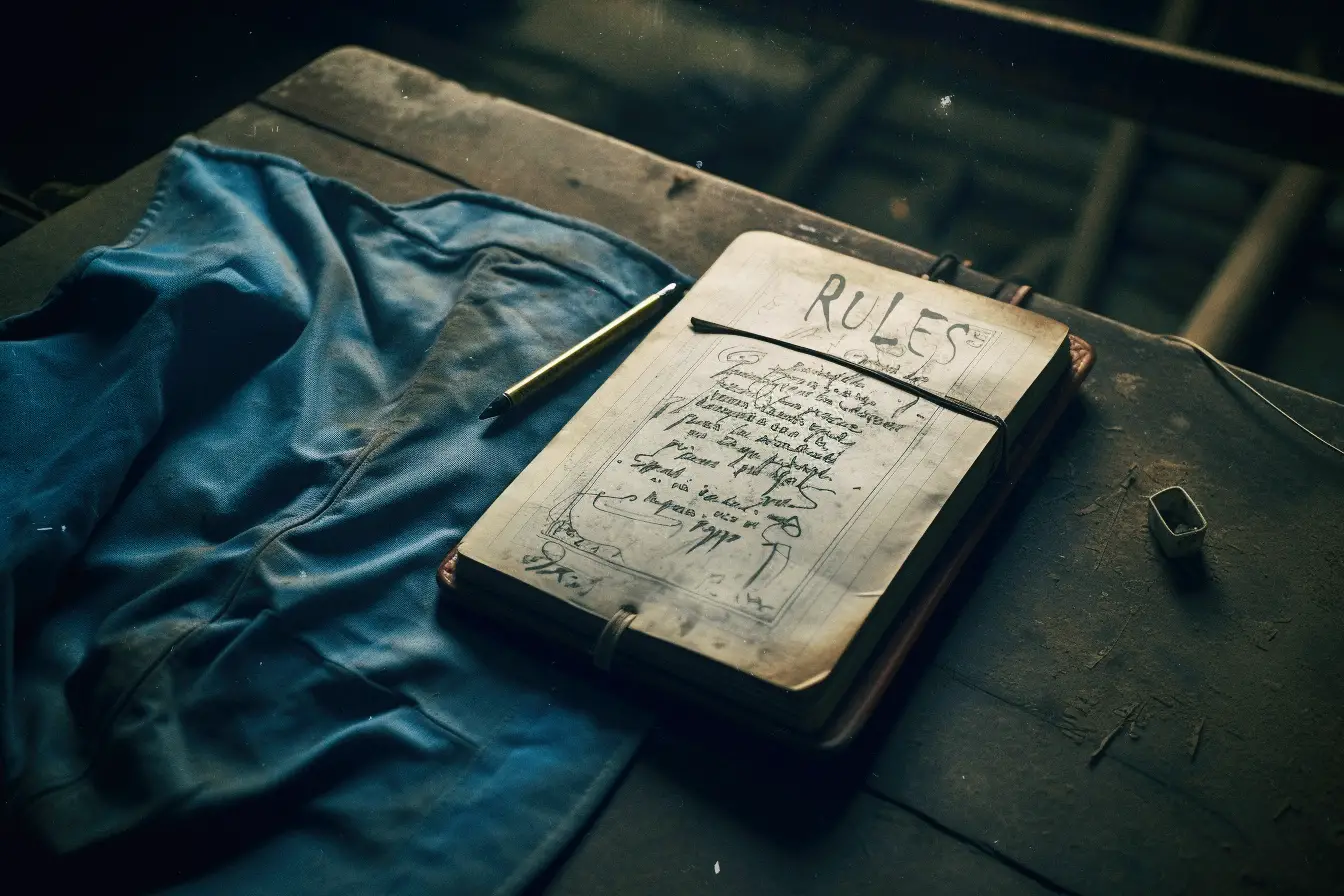

Based on research, academic papers, books, and studies on the mindset and beliefs of broke or poor people, the following would be hypothetical “Poor People Rules” that they follow either consciously or subconsciously to keep them from ever being wealthy or successful at personal finance.

28 Unwritten Rules Of Being Poor:

- Always spend before saving.

- Never invest in self-education.

- Avoid financial literacy at all costs.

- Credit cards are free money.

- Buying items on sale is saving money, regardless of need.

- Ignore your debts, and they will disappear.

- Never plan or budget for your spending.

- Only the wealthy can invest.

- Big houses and flashy cars are a sign of success.

- Don’t have an emergency fund.

- Stick to low-paying jobs and avoid career progression.

- Avoid discussions about money.

- A rise in income should immediately increase lifestyle expenses.

- Financial success is due to luck.

- Keep all your money in a checking account.

- Never negotiate salary or prices.

- The stock market is akin to gambling.

- All debt is bad debt.

- Avoid new income streams (side gigs, passive income).

- Rich people are evil or greedy.

- It’s impossible to become wealthy from a regular job.

- Financial problems are solved by winning the lottery.

- Always buy new instead of used.

- Living paycheck to paycheck is normal.

- Education and degrees are not worth the investment.

- Saving for retirement isn’t a priority.

- Insurance is a waste of money.

- Risk is always bad. Avoid all risks.

Navigating the complex world of personal finance can sometimes feel like stumbling through complex financial decisions without a map for many people. Misunderstood notions and myths often muddle their understanding of both the math and psychology of money, keeping them in perpetual financial hardship. The above widely held beliefs, or ‘rules,’ may covertly undermine your fiscal growth….

Read the full article here