Since this country’s inception, banks have played a significant role in shaping America and its economy. Banks not only help finance infrastructure projects such as roads and bridges, but they also are the lifeblood for small businesses and people trying to find their way to the American Dream.

Understating how banking and money work is directly correlated to wealth in America and sadly, too many Black Americans aren’t well versed enough in financial literacy.

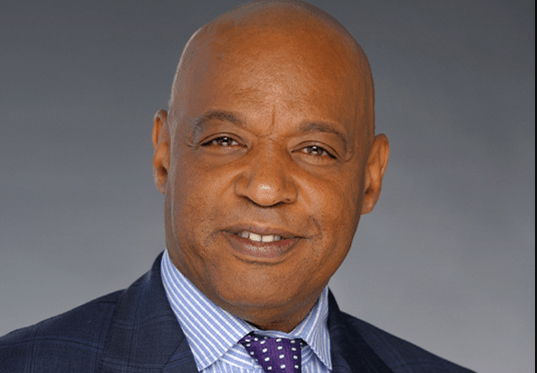

Kevin Cohee, the owner, Chairman and Chief Executive Officer of OneUnited Bank, the largest Black-owned bank and the first Black-owned internet bank in America is trying to change that.

Cohee, a third-generation Alpha Phi Alpha, has a family legacy of helping Black Americans achieve economic success and protection within their communities. His great-great-grandfather, Charles Cohee Jr., (1848-1908) was President of the Chickasaw Freedmen. He went to Congress to fight for equal rights for Black Americans as part of the Dawes Commission. He won 40-acre allotments for Freedmen that fueled Black wealth in Oklahoma and spearheaded what was known as Black Wall Street in Tulsa, Oklahoma’s, Greenwood District.

Kevin followed in his great-great-grandfather’s footsteps, created and spearheaded the Bank Black movement in 2016, establishing the largest Black-owned bank by unifying several community banks across the country: Founders National Bank and Family Savings Bank in Los Angeles, People National Bank in Miami and Boston Bank of Commerce.

He soon realized that banking, like a lot of other industries, was rapidly changing and that adopting technology into his services could be the way to get Black people more educated about money and finances. Kevin Cohee is now focused on using digital tools created by the bank to help low-income families become more financially literate. One of those fascinating tools is called Wise One, a revolutionary AI-driven financial wellness companion to…

Read the full article here